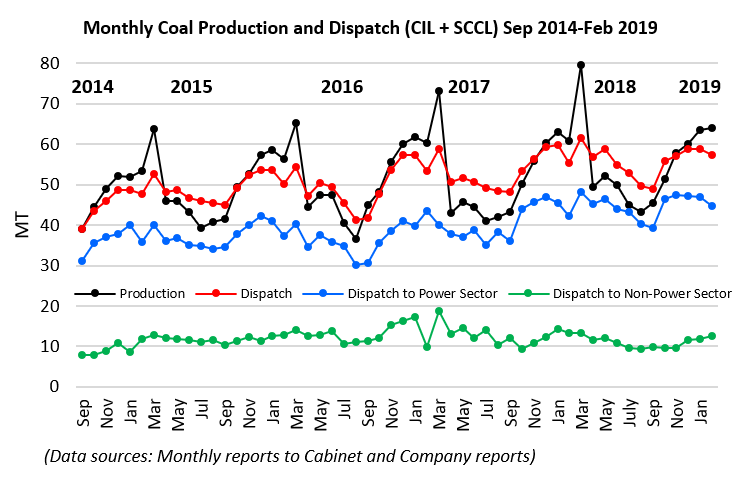

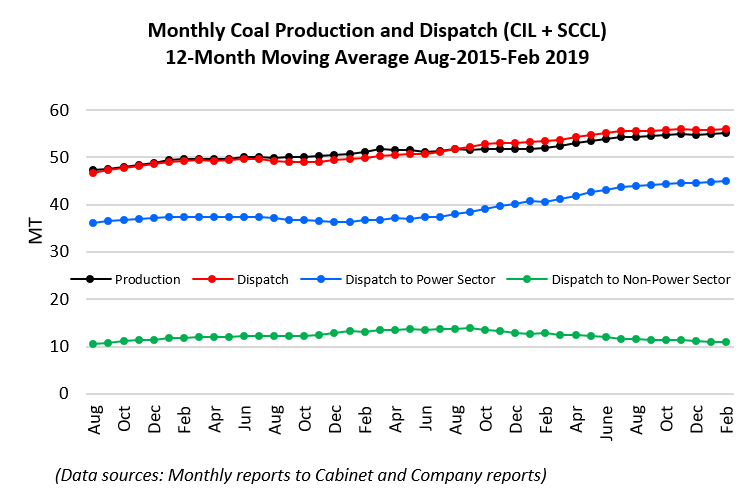

A late pair of updates this month as a result of travel – in India – learning more about energy transition. The last two months’ coal production was modestly higher than the previous year, but dispatch to the power sector fell slightly, offset by higher deliveries to the non-power sector.

Twelve-month moving average data shows that production and dispatch remain in rough balance, but that the growth rate of dispatch to the power sector is less marked than 8-9 months ago. Deliveries to the non-power sector, which have been falling to accommodate increased power sector dispatch, show signs of stabilising.

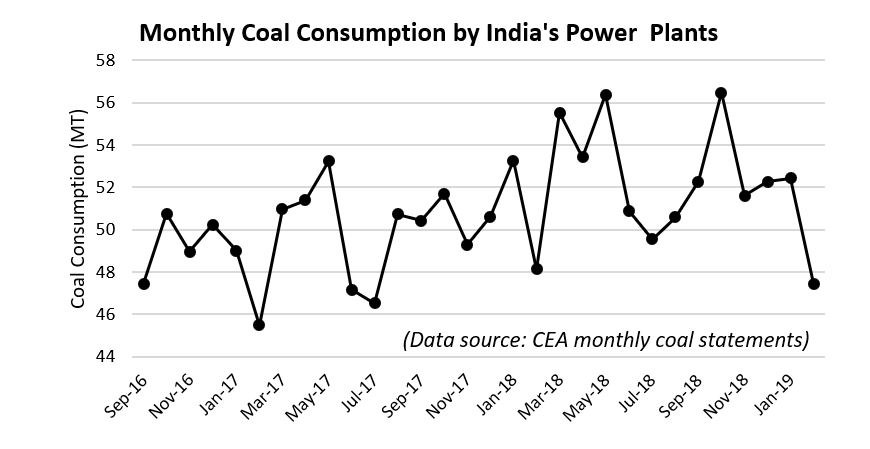

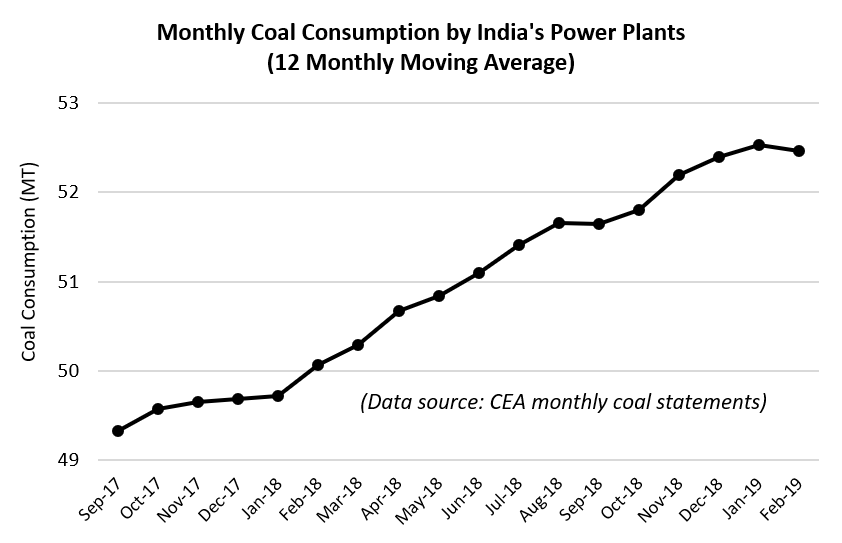

January and February saw slightly less coal burned for power than in the corresponding months in 2018.

As a consequence, the 12-month moving average up to this February showed a rare downturn.

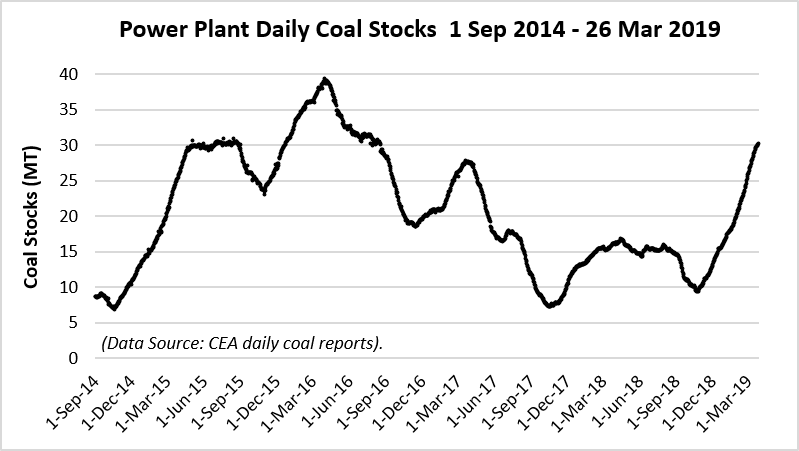

The combination of more coal arriving at power stations and marginally decreasing consumption has seen the fastest re-stocking rate in recent years, and the second largest absolute increase in power station stocks in five years. This appears ready to peak somewhere in the vicinity of 32 million tons.

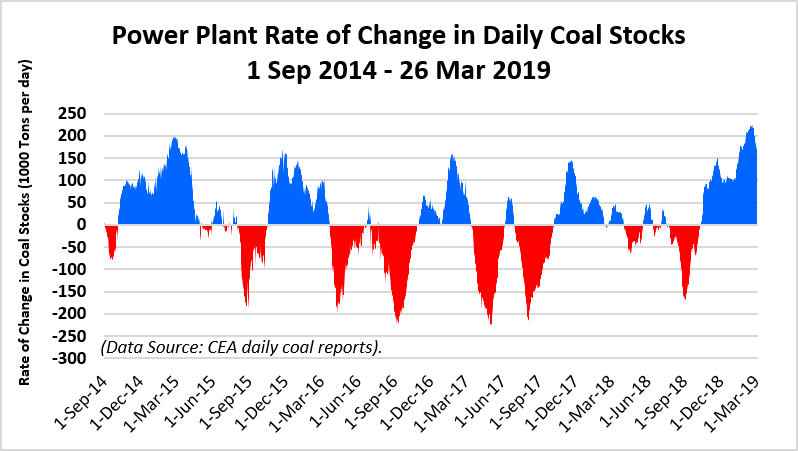

The high restocking rate is very evident in the next plot, which shows the rate of change in daily coal stocks, smoothed with a 21 day moving average.

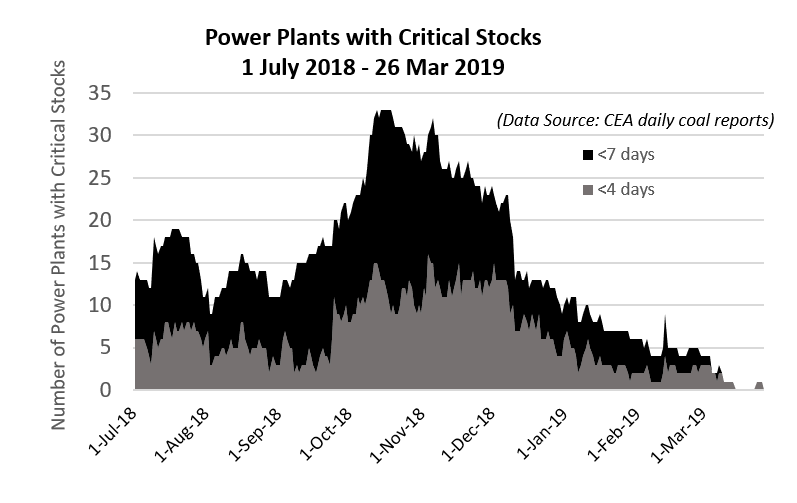

This month we also show the number of power plants deemed to be critically low on stocks, using the CEAS’s < 7 days supply and < 4 days supply criteria. These have plummeted to zero or one from a peak of 33 last October.

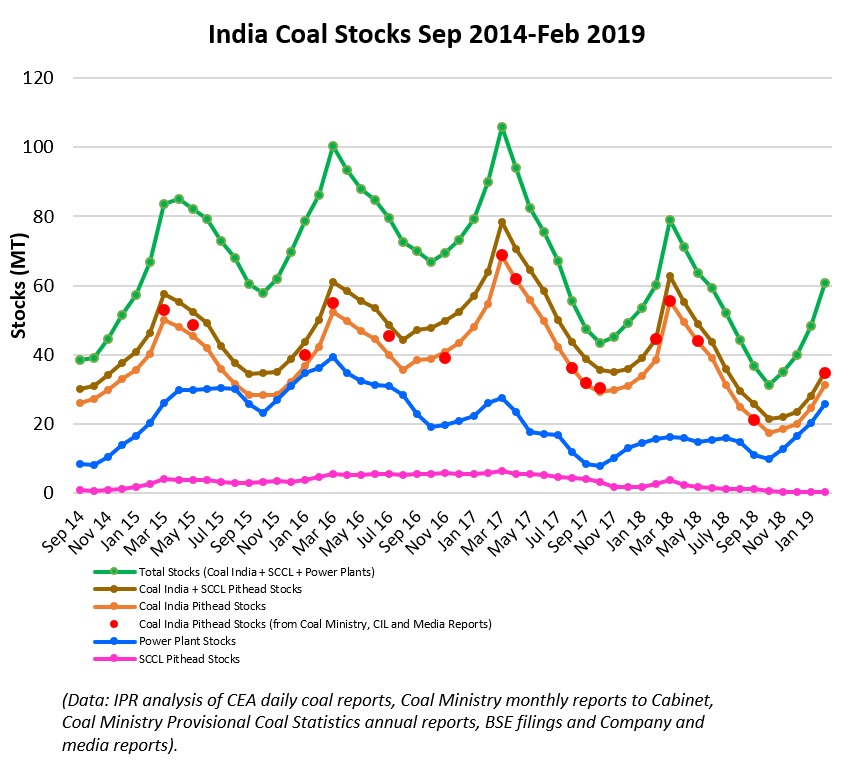

Putting this information together, it is still the case that India’s overall coal stocks are likely to peak soon at the lowest overall level for the last five years. However, the much decreased pithead stocks this year, combined with the significantly greater quantity held at the power plants, should see a smaller number of plants experiencing acute shortages this summer.

Be the first to comment