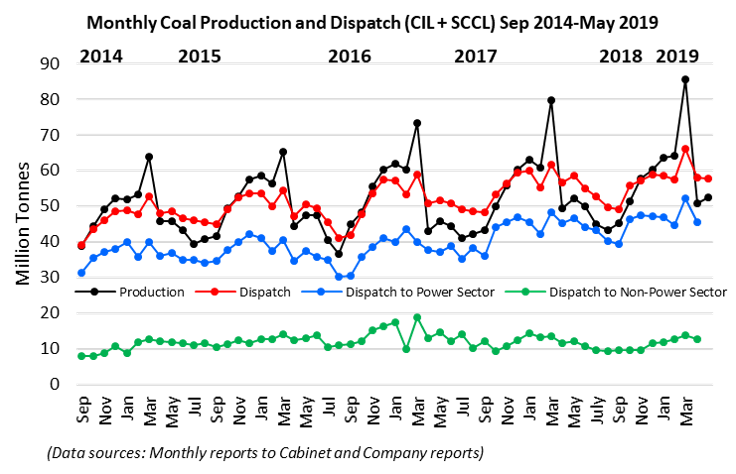

Apologies for the delay in posting. Production from Coal India and SCCL together exceeded 50 MT in each of the last two months, while dispatch did not change substantially from the same months last year.

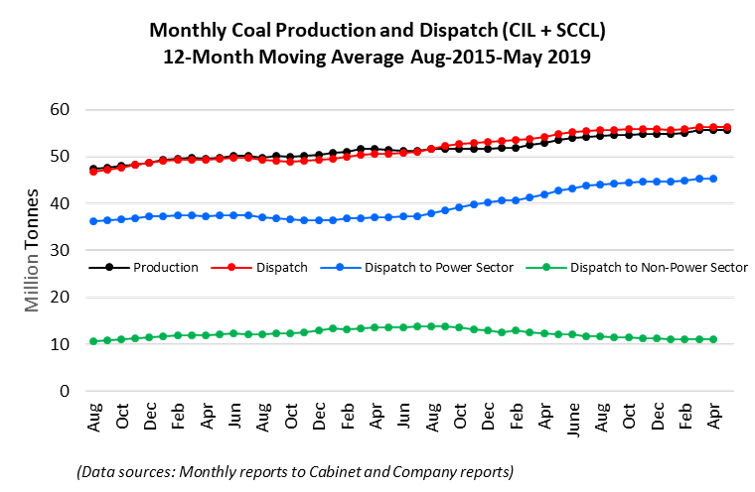

The 12-month moving average data over the last five years shows a long-term rate of production increase for Coal India (CIL) and SCCL combined of about 25 MT per year.

In 2015 Coal India set a one billion ton production target for the current financial year, and with a year to go it was 397 MT short of that target. When the inevitable was finally acknowledged late last year, this goal was postponed to 2026. What do historical trends tell us about this revised goal?

Coal India would need to surpass its very large production increase of last year to meet it, as a sustained 40 MT annual increase would not see the goal reached before 2029.

If, on the other hand, CIL continues its average rate of increase for the last five years, then it will be 2036 before the company mines a billion tons.

History may not be much of a guide, though, given that so much energy and climate policy will be unfolding long before 2026, let alone 2029 or 2036.

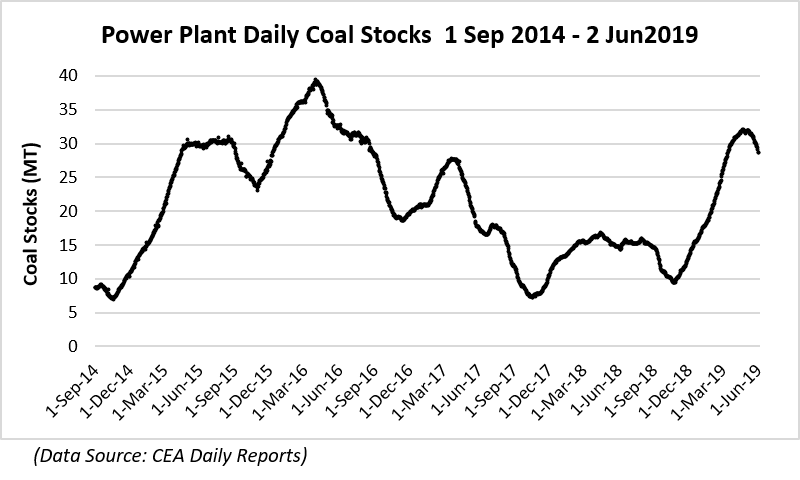

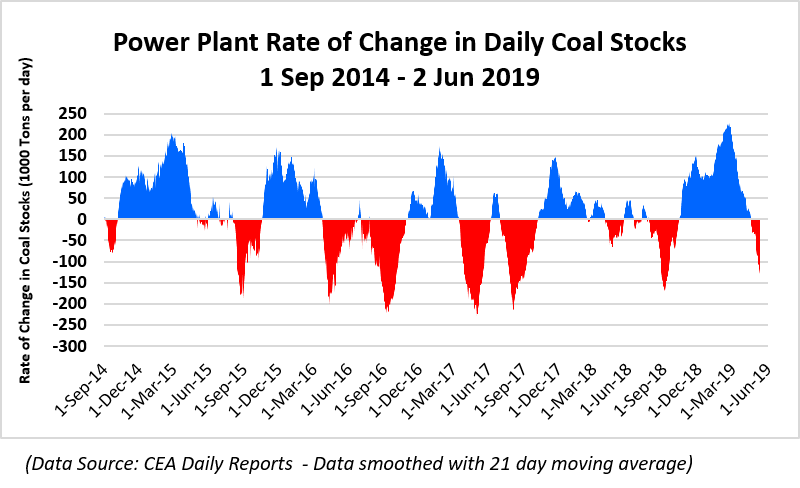

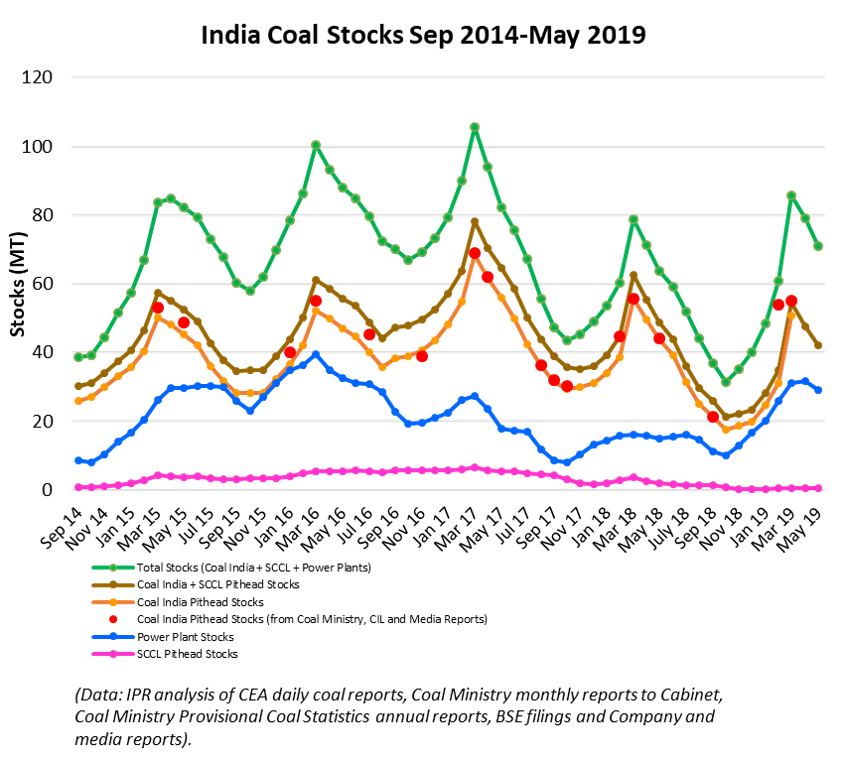

Currently at about 28 MT, power plant coal stocks commenced their annual decline in late April. This is about three weeks later than in the last three years.

Power plant stocks have tended to moderate (or even briefly reverse) their decline when monsoon-related increases in wind and hydro generation reduce coal use.

Despite a late arrival of the monsoon, this delayed start to the drawdown may mean that stocks could temporarily stabilise at a relatively high level in the next few weeks, perhaps in the order of 25 MT, before resuming a faster rate of decline.

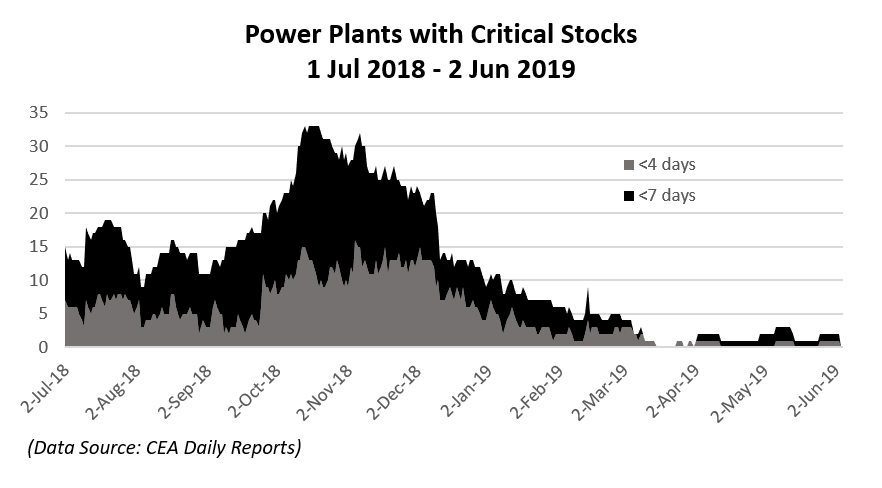

The relatively high stocks at power plants mean that very few plants are at critically low levels compared to last year.

Total coal stocks in May were at about 71 MT, a little closer to last year’s value of 64 MT than the average from 2014-16 of about 84 MT. The big difference is that much more of those stocks are at the power plants – about 28 MT, nearly double last year’s May figure of 15 MT, and higher than the 27 MT average for 2014-16.

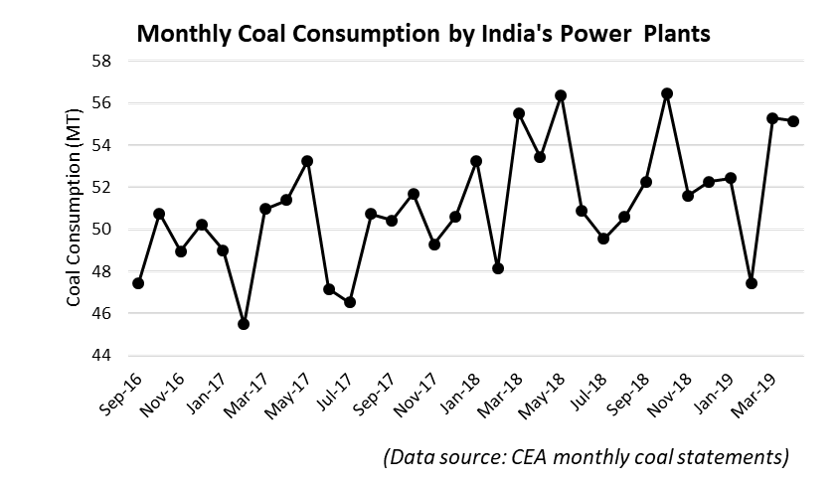

With only 28 days and moderate weather, February is normally a low month for coal consumption at India’s power plants, and the increase in April and May are typical.

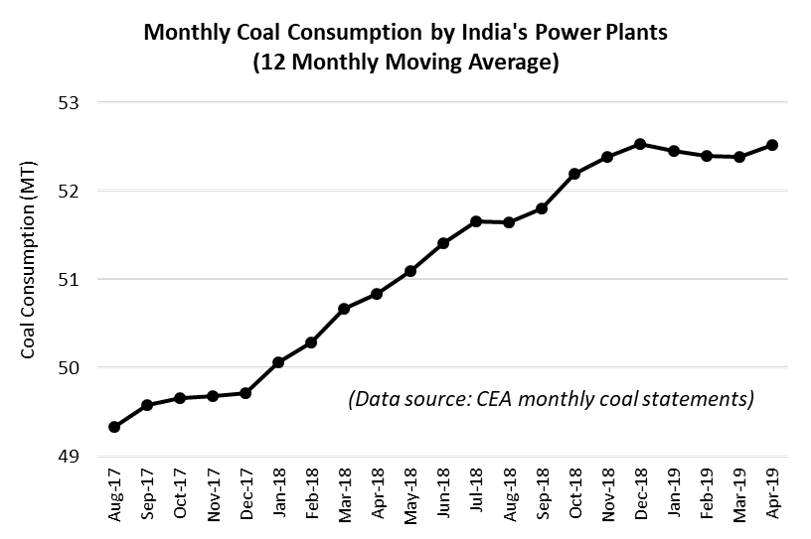

More intriguing is the recent plateauing of coal consumption when expressed as a 12-month moving average. How long will this persist? Preliminary generation data for May and early June suggests that a modest increase in thermal coal use may soon resume, but the longer-term trend is both difficult to predict and potentially very revealing about India’s power trajectory.

Be the first to comment