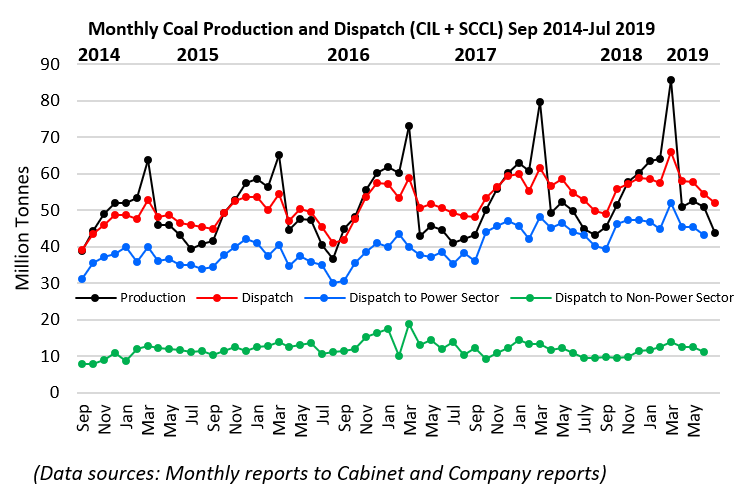

July’s production fell slightly year-on-year at CIL, and SCCL’s much smaller production could not make up the difference even though it grew.

With each passing month, the emphasis given over the last year-and-a-half to supplying the power sector stands out, but so does the corresponding stasis in supply to all the other sectors, no higher now than four years ago, while the power sector receives an extra 9 MT per month.

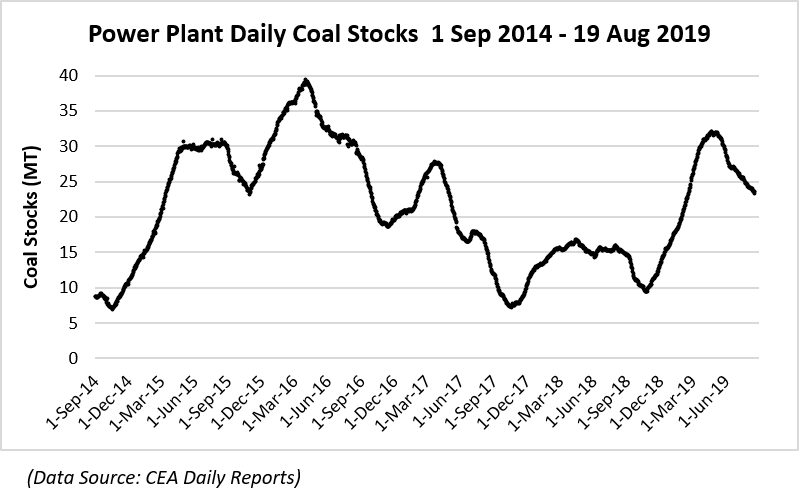

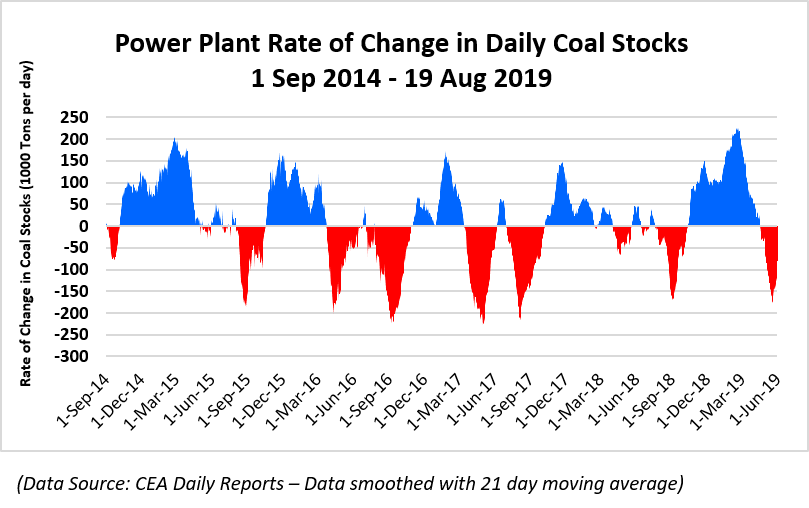

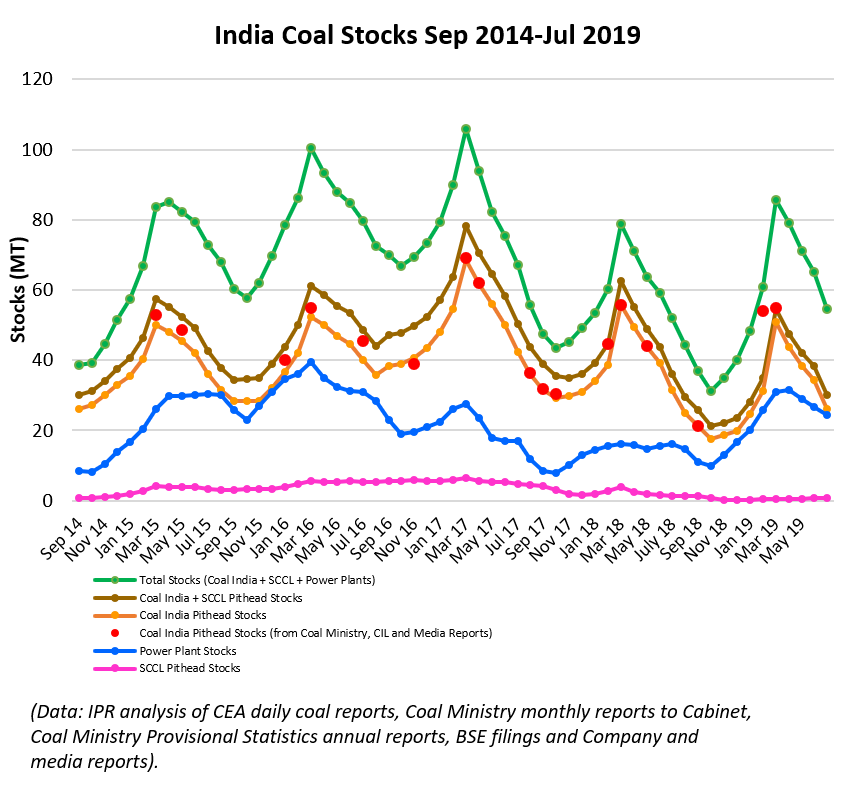

Coal stocks at power plants are declining at only a modest rate and still stand at more than 23 million tons.

The rate of decrease in these stocks, at about 60,000 tons per day, is less than half its peak de-stocking rate of about 180,000 tons per day, reached in June.

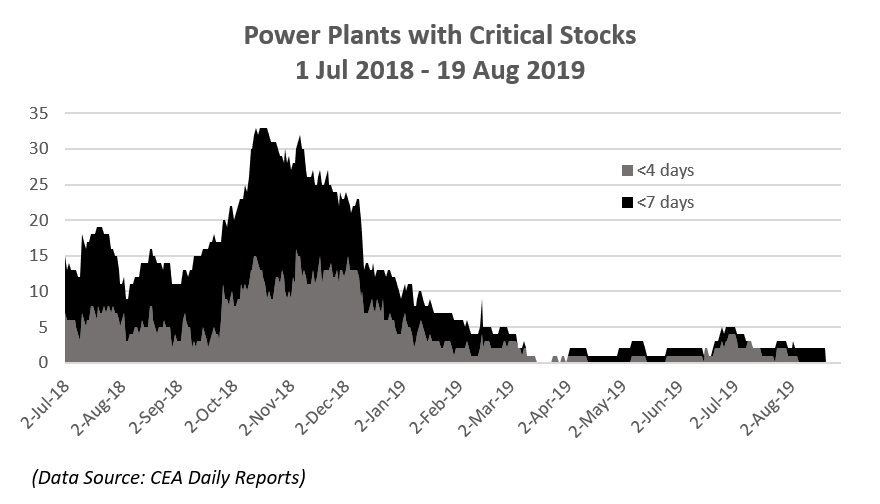

The panic headlines of critical power plant coal shortages of last year and the year before are, in consequence, nowhere to be seen this year.

Nonetheless, total stocks, combining those at the pithead and power plants, have actually fallen more from their peak this year than last. There’s just that much more coal sitting at the power plants.

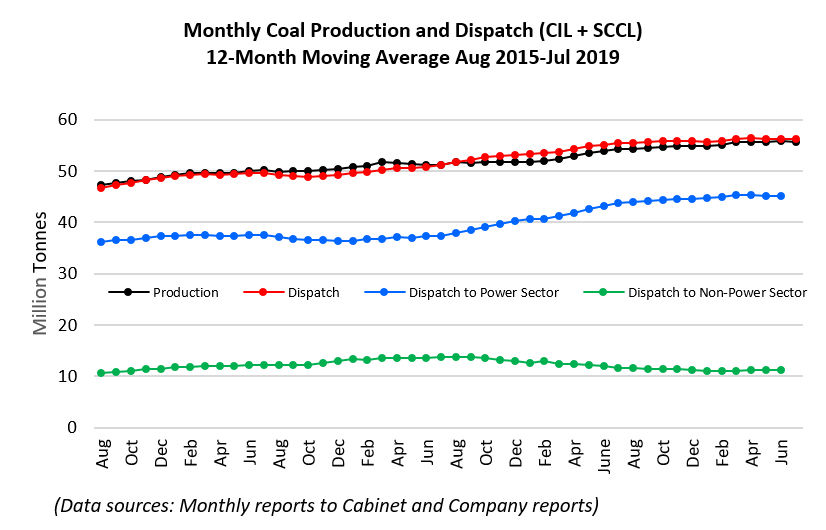

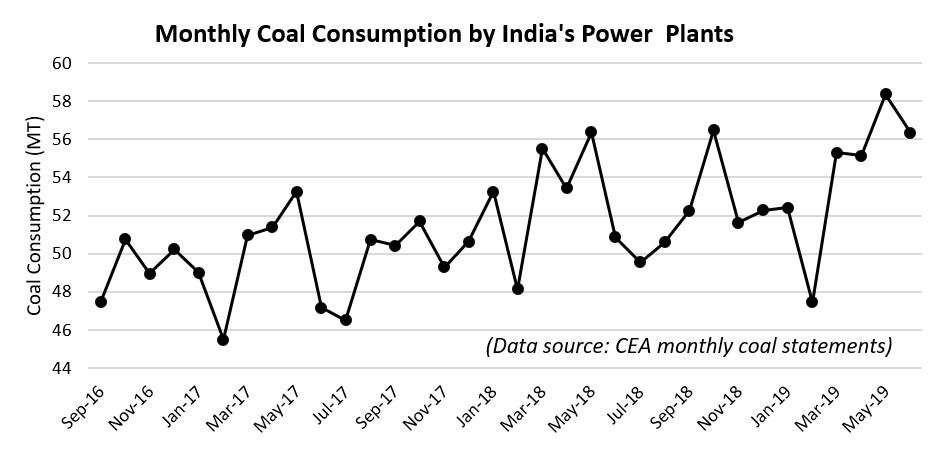

Even though coal consumption for power has resumed its increase, the last few months of minimal or no growth mean that it remains below its recent rate of increase.

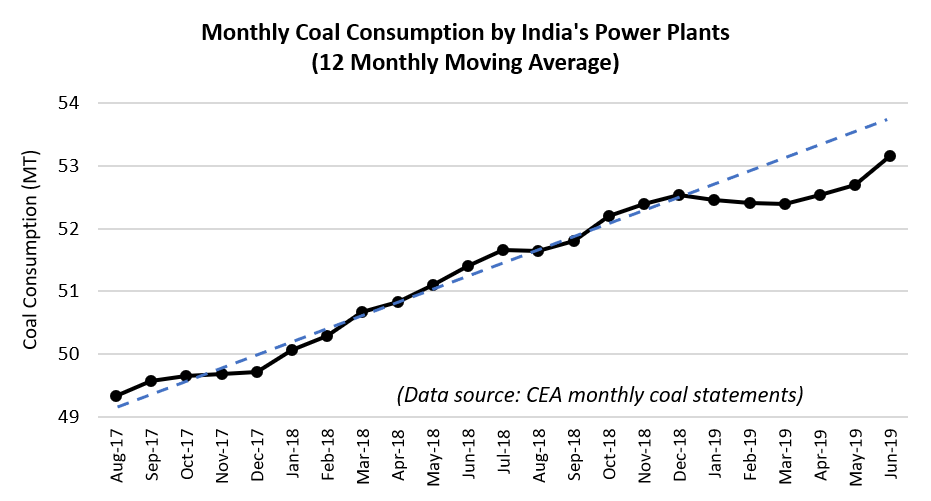

This is especially evident in the 12-month moving average data, which shows there is still a deficit in the growth rate relative to the linear fit for the period August 2017 to December 2018 projected forward until this July. That’s because India continues to generate new energy that is increasingly from non-coal sources.

Be the first to comment